1. Executive Summary

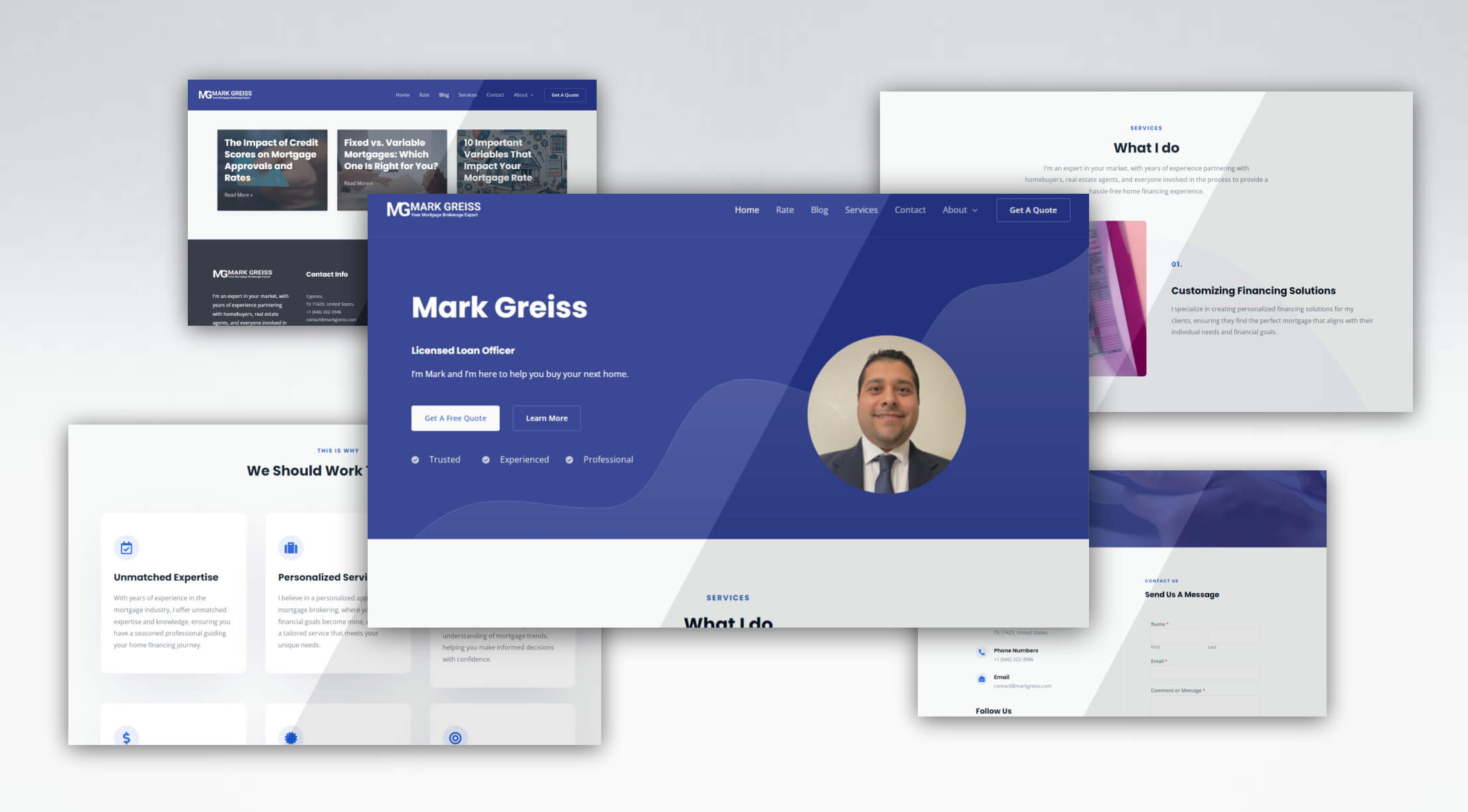

Mark Greiss, a licensed loan officer, specializes in providing personalized mortgage solutions and expert guidance for homebuyers. This case study explores his background, challenges, implemented strategies, and the impact of his services. The website was created and supported by Repixe, a digital marketing agency known for its expertise in developing engaging and effective online presences.

2. Company Background

Mark Greiss is a licensed loan officer based in Cypress, TX, with years of experience in the mortgage industry. He partners with homebuyers, real estate agents, and other stakeholders to ensure a seamless and hassle-free home financing experience. His mission is to provide clients with customized financing solutions that align with their unique needs and financial goals.

3. Business Challenges

Market Competition: The mortgage industry is highly competitive, with numerous loan officers and financial institutions vying for clients.

Client Education: Many homebuyers are unfamiliar with the complexities of mortgage options and the financing process, requiring comprehensive guidance and education.

Trust and Reliability: Establishing trust and demonstrating reliability to potential clients is critical in an industry where financial decisions are significant and impactful.

4. Solutions Implemented

Customized Financing Solutions: Mark Greiss offers personalized mortgage options tailored to each client’s financial situation and goals. This approach ensures that clients receive the best possible terms and rates.

Competitive Rates: By providing access to a wide range of loan options and the most competitive rates, Mark helps clients make informed decisions with ease.

Expert Guidance: Mark offers end-to-end guidance throughout the home buying process, from initial consultation to closing. This comprehensive support ensures a smooth and stress-free experience for clients.

5. Results and Impact

Growth Metrics: Mark Greiss has seen a steady increase in client referrals and positive testimonials, reflecting high levels of customer satisfaction.

Client Satisfaction: Personalized service and expert guidance have resulted in high client retention rates and numerous successful home financing transactions.

Successful Case Studies: Examples include helping first-time homebuyers secure favorable mortgage terms and assisting clients in refinancing their homes to reduce monthly payments and save on interest.

6. Analysis

SWOT Analysis:

Strengths: Personalized service, deep market knowledge, and a strong network of industry partners.

Weaknesses: High competition and the need for continuous client education.

Opportunities: Expanding services to include financial education workshops and leveraging digital marketing for broader reach.

Threats: Economic fluctuations and changing mortgage regulations.

Competitor Analysis: Mark Greiss stands out by offering a highly personalized approach and comprehensive support, differentiating himself from competitors who may offer more standardized services.

Market Positioning: Positioned as a trusted and experienced mortgage advisor, Mark Greiss focuses on client success and personalized solutions.

7. Future Outlook

Service Expansion: Plans to introduce financial education workshops and online resources to help clients better understand mortgage options and the financing process.

Technological Integration: Utilizing digital tools and platforms to enhance client communication and streamline the mortgage application process.

Market Expansion: Targeting new markets and demographics to broaden the client base and increase brand awareness.

Long-Term Goals: Establishing a reputation as a leading mortgage advisor known for personalized service and expert guidance, ultimately becoming a go-to resource for homebuyers and real estate professionals.

8. Conclusion

Mark Greiss’s approach highlights the importance of personalized service, expert guidance, and client education in achieving success in the mortgage industry. His commitment to understanding and meeting client needs has significantly contributed to his growth and positive reputation.